Affidavit of Exemption From Withholding Concerning

Non-Taxpayer Jason Michael Bobbitt

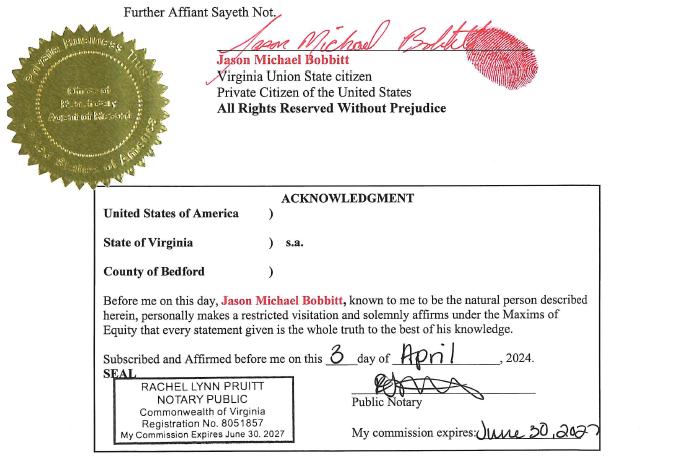

Accordingly, I, Jason Michael Bobbitt, in esse and sui juris, being duly sworn, depose and declare that the following facts are true, correct, and complete to the best of my knowledge and belief.

- Affiant was naturally born in the geographic United States of America, in the State of Virginia, on a location within the city of Roanoke, on the Twenty-sixth day of April, in the year of our Lord Nineteen-Hundred and Seventy-Six.

- Affiant, a natural person became a de jure, natural born Private Citizen of the United States of America on the day of his natural birth pursuant to the Fifth Amendment to the Constitution of the United States, and therefore;

- Affiant, a natural person, became a de jure, natural born Private Citizen of the Virginia State on the day of his natural birth pursuant to the Fourteenth Amendment to the Constitution for the United States of America.

- Affiant, by operation of law, AND BY MISTAKE OF MY PARENTS, was pledged as Property for, wedded to and made Surety for, a de facto, artificial person, state-created, quasi-business trust, statutory, D.C. Territorial, U. S. citizen by means of a STATE OF VIRGINIA CERTIFICATE OF LIVE BIRTH filed with the County of Roanoke, on May 3, 1976;

- Affiant, by operation of law, was restored to his former status of being a Private Citizen of the United States of America: American National upon the public filing of a “Release With Consideration—Nunc Pro Tunc Ab Initio” with the County Recorder, Big Horn, Montana;

- Affiant has eliminated any presumption that Affiant is Property / Surety for, and/or wedded to said statutory D.C. Territorial, Public “U.S. citizen” by Affiant’s public filing a “Rescission of Signatures of Suretyship—Nunc Pro Tunc Ab Initio” with the County Recorder Big Horn, Montana. Affiant makes his home in Moneta, Virginia, in the county Bedford, where Affiant privately resides on the land under special equitable interests by nature and does not publicly reside is said county according to statute; federal nor state.

- Affiant, by virtue of his constitutionally protected status of being a Private National Citizen of the United States of America, is foreign to the present de facto, Emergency War Powers, Roman Civil Law-based martial due process of the courts of the United States and the courts of the several states, the former de jure, Constitutional Common Law-based, civilian due process (of the United States) and the Common Law-based civilian due process of the several states (guaranteed to all Private American National Citizens by Section 1 of the 14th Amendment) having been altered and/or modified into the present de facto, Emergency War Powers, Roman Civil Law-based, martial due process of the several states by a congressionally-amended, World War I statute (“Trading With the Enemy Act”) called the “Emergency Banking and Relief Act” (12 U.S.C. 95a) and a subsequent Presidential Proclamation 2040, both events on March 9, 1933.

- Affiant is not a statutory public “U.S. citizen”.

- Affiant is not a statutory public “resident” of the United States.

- Affiant is not a statutory public “United States person”.

- Affiant is not a statutory public “non-citizen national”.

- Affiant is not a statutory public “citizen” of the STATE OF VIRGINIA.

- Affiant is not a statutory public “resident” of the STATE OF VIRGINIA.

- Affiant is not a statutory public “resident alien”.

- Affiant is not a statutory public “non-resident alien”.

- Affiant is not a statutory public “taxpayer”.

- Affiant is not a statutory public “non-taxpayer”.

- Affiant does not have a statutory public “tax home within or without the United States” presently under military occupation via the “Trading with the Enemy Act” (1917) amended by the “Emergency Banking and Relief Act” (March 9, 1933).

- Affiant, in holding the citizen status of a Pre-1933 Private American National Citizen of the United States secured by the Fifth Amendment to the Constitution for the United States of America, specially and privately residing in equity in the State of Virginia, is not subject to the Internal Revenue Code as it applies only to a “person” defined under the “Emergency Banking and Relief Act” of March 9, 1933;

- Affiant as a matter of public record; is the Non-Surety Agent of Record for the unincorporated, non-statutory Private Business Trust and de jure “JASON MICHAEL BOBBITT” created by Grantor-Settlor Jason Michael Bobbitt. The Private Business Trust “JASON MICHAEL BOBBITT”, as a matter of public record, is presently under a special and private trust arrangement governed by the Maxims of Equity, where, by the Judicature Act of 1873 in operation today, “When the rules of common law and the rules of equity conflict over the same subject matter, the rules of Equity shall prevail.”

- Affiant declares that the Private Business Trust “JASON MICHAEL BOBBITT” is a vessel in domestic and world commerce for the benefit of a special Sole Beneficiary holding the status of a Pre-March 9, 1933, Private American Citizen of the United States of America secured by the Fifth Amendment to the Constitution for the United States of America, all income received, by the Private Business Trust “JASON MICHAEL BOBBITT” being the special and private equitable property by nature of the Heir and Sole Beneficiary;

- Affiant, based upon the above, declares that the Private Business Trust “JASON MICHAEL BOBBITT” is a Non-taxpayer, having no “income or wages”. Other “private earnings” being the special and private equitable property of the Sole Beneficiary of the Private Busines Trust JASON MICHAEL BOBBITT (non-resident alien for income tax purposes).

- Affiant, declares the Private Business Trust “JASON MICHAEL BOBBITT” has never received, nor shall ever receive, any beneficial income, including profit and/or gain from any “source”, income derived from wages, tips, salaries, etc. whatsoever, has never had a past or present tax liability, and is therefore exempt from any form of backup withholding by any business, public or private, and exempt from withholding by any employer, public or private, affiant further declaring that all income taxes previously paid to the de facto military government of the United States to be a gift;

- Affiant declares this Affidavit of Exemption from Withholding Concerning Non–Taxpayer “JASON MICHAEL BOBBITT", a Private Business Trust (non-resident alien for income tax purposes) Nunc Pro Tunc Ab Initio renders null and void any previous Affidavit of Exemption from Withholding filed with any public office.

Maxim: “Equity regards as done that which ought to have been done”.